Before unconventional resources became prevalent in the global petroleum supply, deepwater exploration and development (1,500 feet of water depth or deeper) was a significant focus for many larger companies. For deepwater activities to succeed, the petroleum industry was forced to merge its above-ground concerns with the below-ground geoscience and engineering disciplines.

Above-ground issues had five related aspects (figure 1):

- Regulatory framework for each country and first discoveries

- Subsurface risk reduction

- Drilling and completion technologies

- Field development infrastructure

- Economic considerations

Evolution of Deepwater Regulation

A fundamental aspect of deepwater exploration and production was the need for governments to develop a regulatory framework for companies to operate and develop resources (figure 2). The first of many steps was convincing the regulators that there was high upside potential for extensive petroleum deposits in their deepwater basin(s), and that these deposits could be developed in an environmentally safe matter. In general, regulators could extend their existing framework for shallow-water drilling.

The process was slow and developed at different rates in different countries.

A second step was that certain countries did not allow foreign investment and drilling until, first, the deepwater play had been proven in other basins globally, and, second, government polices changed to allow for international oil companies to participate in offshore development. These include West African countries including Nigeria and Angola, as well as Brazil, and Mexico in 2016. Some countries had no petroleum development on their continental shelves and deepwater drilling was a bigger unknown (such as India, Malaysia and Mauritania-Senegal).

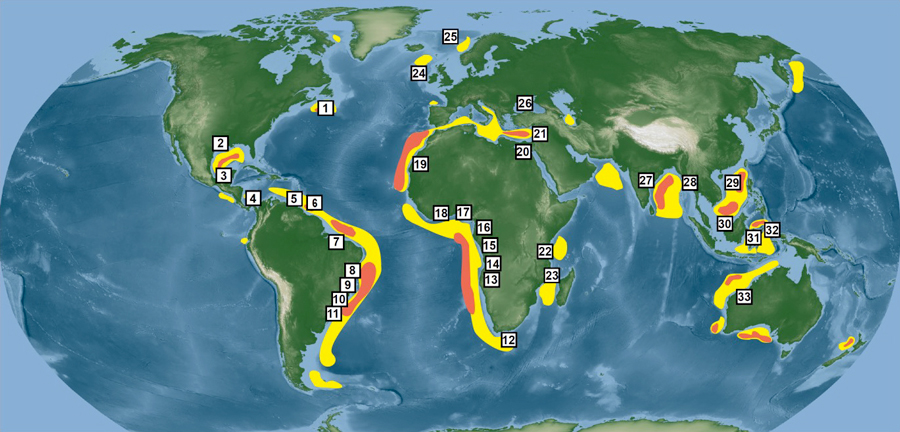

The first lease rounds and subsequent discoveries in new deepwater basins started slowly, but have increased considerably since 2010. The first discovery in deepwater was in 1978. Two new basins were added in the 1980s, 11 new basins in the 1990s, seven new basins in the 2000s and 12 new basins since 2010. (figure 3)

Figure 3. Global map of all basins in greater than 1,500 feet water depth with fields or economic discoveries.

For each basin, the first discovery and its year are listed in parentheses.

1. Eastern Canada (Bay du Nord, 2015)

2. Northern Gulf of Mexico (Jolliet, 1981)

3. Southern Gulf of Mexico (Lakach, 2004)

4. Colombia (Kronos, 2015) 5. Trinidad and Tobago (LeClerc, 2016)

6. Guyana (Liza, 2015)

7. Potiguar (Piti, 2014)

8. Sergipe Alagoas (Moita Bonita, 2012)

9. Espirito Santo (Tanganika, 2014)

10. Campos (Albacora, 1984)

11. Santos (Tambuatá, 1999)

12. Outeniqua, (Brulpadda, 2019)

13. Angola (Girassol, 1996)

14. Cabinda (1997)

15. Gabon (1998)

16. Equatorial Guinea (Zafiro, 1995)

17. Nigeria (Bonga, 1995)

18. Ghana-Cote D’Ivoire (Jubilee, 2007)

19. Senegal-Mauritania (Chinguetti, 2001)

20. Nile (Rosetta, 1997)

21. Levant (Mari-B, 2000)

22. Tanzania (Pweza, 2010)

23. Mozambique (Windjammer, 2010)

24. Shetlands (Foinaven, 1993)

25. Central Norwegian shelf (Ormen Lange, 1997)

26. Black Sea-Romania (Domino, 2012)

27. Krishna-Godivari (R-1:Annapurna, 2001)

28. Myanmar (Mya South, 2007)

29. South China Sea (Lingshui 17-2, 2015)

30. Brunei-Sabah (Kikeh, 2002)

31. Mahakam (West Seno, 1998)

32. West Philippine Sea (Malampaya, 1993)

33. NW shelf- Australia (three sub-basins; Scarborough, 1978).

Areas with good exploration potential are shown in yellow (deepwater, 1500-6000 feet) and orange (ultra-deepwater >6000 feet).

The framework for license acquisitions also varied considerably among different countries. Two general approaches evolved for the licensing and acquisition of exploration blocks: direct negotiation and bidding rounds.

Direct negotiation with governments is common in countries with unproven petroleum provinces. Examples of direct negotiation include the initial deepwater blocks licensed in Israel and Egypt. No bids rounds are held, so companies are free to approach governments on an ad hoc basis.

The second approach – licensing by bidding rounds – is more common.

Four general types of bidding have been employed (figure 2):

● Sealed bids with signature bonus (i.e., up-front cash bonus) as sole criteria: Winner receives the mineral rights to the acreage, an undeveloped discovery or to develop discoveries being sold. The bid has no work program or spending commitment. One example is the U.S. deepwater Gulf of Mexico, where Outer Continental Shelf lease sales have been held since the 1960s and where deepwater production was established in the 1980s.

● Sealed bids with a work program: The bidding party bids a proposed scope-of-work program by committing to acquire seismic, drill wells, etc. This type of bid is common with many governments, especially those with production sharing contracts. Examples are offshore Newfoundland and Labrador, where recent deepwater bid rounds employed sealed bids, with the work program as the sole biddable parameter. Australia also employs a sealed work program bid, with companies nominating acreage for each future bidding round.

● Sealed bids with contract terms: The biddable parameters comprise a combination of contract variables (such as royalty rate, production share, cost recovery, signature bonus, etc.). Examples include Mexico offshore bid rounds, which commenced in 2016 and include deepwater acreage in several basins.

● Open gazettal: For this system, the biddable parameters are signature bonuses, work program or contract terms. The bids are then submitted and published for 30-90 days, during which time other companies can submit competing bids. For example, open gazettal is required by the European Union, and several member countries have awarded deepwater licenses through this process.

In summary, most countries have employed some combination of two of these bidding approaches. In addition, for many countries, the awarding of licenses has evolved thorough time. For example, Flavio Feija writes that in Brazil, initial licenses were held by state monopoly (1954-97) with the exception of 43 risk contracts (1975-88). However, from 1998-2018, bid terms required the winners to pay a bonus, commit to an exploratory program and purchase local goods and services. Since 2018, exploratory blocks have been offered on a permanent basis, with companies being able to bid anytime. Furthermore, since 2010, in the Santos Basin, production-sharing contracts have been implemented for the pre-salt fields, where the bid winner commits to provide part of the oil production to a state company. One additional complexity is that in some deepwater basins, changes in government have also led to changes, such that awarded licenses were later terminated.

Once the licensing rules were developed, countries used different approaches to define the size of deepwater exploration blocks and the duration of the licenses. In the early 1980s, the OCS annual leasing system for the U.S. Gulf of Mexico defined lease blocks of three mile-by-three mile-grid; leases varied from five to 10 years in length. These smaller block sizes encouraged companies to both compete and cooperate in a closed bidding system. In all other countries, blocks were considerably larger, varying from tens to hundreds of kilometers in length and width (this pattern first established in the North Sea). This approach allowed companies to completely evaluate the entire geology of a block and develop a more complete understanding of the broader area prior to exploration drilling. The length of the licenses varied between countries.

A final important event that affected the global regulation of deepwater basins was the Macondo drilling accident of April 2010. The response of the countries with active deepwater projects was to freeze all drilling activity until the accident was investigated and regulators felt that their countries were safe from a similar disaster. The results were major improvements in the process and technology that further reduced the risk of such blowouts (“avoidance”) and were ready for deployment in case another accident happened (“containment”). The effect on global deepwater drilling was to stop drilling activity for about one year. In the GOM, no new leases were approved until 2011, and the first well was drilled nine months after the accident.

Evolution of drilling and completion technology

The technologies used to develop deepwater fields are extremely advanced, representing some of the most complex, large-scale construction techniques in history.

Shallow-water drilling uses fixed in-place facilities such as jack-up and fixed leg.

However, these fixed facilities cannot be used economically for water depths of 1,500 feet or deeper. Drilling safely in deepwater required many new engineering techniques. As a result, deepwater rigs have no fixed legs and are kept in position by various devices collectively termed “floaters.”

There are two general types of floaters (figure 1): semi-submersible rigs held in position by mooring lines to the ocean floor; and drill ships, which employ dynamic positioning (using thrust from an array of engines).

The Glomar Challenger was the first drillship used for scientific deepwater drilling; this research vessel was developed in association with Deep Sea Drilling Program and launched in 1968. Because scientific drilling does not use risers (i.e., a large diameter, low-pressure main tube that allows for control of circulating fluids and blow-out prevention) required for exploration drilling, the maximum drilled water depth is 7,044 meters in the Marianas Trench. This is considerably deeper than the deepest water exploration well, the Ondjaba-1, which was 11,909 feet (3,630 meters) in Block 48, offshore Angola.

The first commercial exploration drillship was launched in the mid-1970s. Since then, six generations of drillships have been developed with increasing technical capabilities. Drillship generations are defined by the drilling industry, based on technical capabilities (such as water depth, drilling depths in subsurface).

A major factor in deepwater economics is the cost of drilling the wells with these floating rigs, particularly the day rate and spread rate. The day rate is simply the rental cost of the rig itself. Day rates are largely driven by market conditions (supply and demand) and have ranged from less than $100,000 per day to more than $500,000 in 2013-14.

In a high-level budget, the spread rate will include: capital goods, tangible drilling supplies (tubing, casing, downhole equipment) and services (mud management, logging, cementing, standby vessels) and all associated staffing costs.

Typically, in deepwater, the spread rate is double the day rate. Thus, before the decrease in oil price in 2014-15 (figure 1), deepwater spread rates of more than $1 million a day were common. Drilling deeper wells in the Gulf of Mexico and elsewhere can often take six months or more, with the total wildcat cost sometimes exceeding $200 million.

Another critical development for deepwater activity involved changes in the completion technology used to develop the reservoirs. During the 1980s and ‘90s, deepwater discoveries were primarily in Oligocene and younger reservoirs in the northern Gulf of Mexico, Brazil and West Africa. These reservoirs had relatively low temperatures, with little to no diagenesis and limited induration. Thus, when cores were taken, they would commonly expand and break into sediment on the surface. Developing these reservoirs was an engineering challenge because some of the initial deepwater fields had considerable sand flowage into the borehole, thus causing the reservoirs to stop producing prematurely.

By the mid-1990s, however, hydraulic fracturing and gravel packing (frac-packs) technology was developed, allowing these reservoirs to be developed at much higher rates. With gravel packs, a screen is placed next to the borehole to stop the flow of sand. As a consequence, high-rate, high-ultimate production wells could be developed at rates up to 50,000 to 60,000 barrels a day per well.

Subsea tiebacks, a technology initially designed for production on continental shelves, quickly became a global standard technology for deepwater development beginning in the 1990s. This technique was increasingly used to develop marginal oil and gas fields in economic ways because fewer surface facilities were required. For example, in the northern deepwater Gulf of Mexico, more than 60 percent of the fields are produced entirely via subsea tieback to other surface production facilities. Subsea tie-backs usually require significantly lower initial investments, compared with developments using floating production storage offloading units or other fixed installations.

Reducing Technical Risk

Reducing technical risk was absolutely essential to solving the economic unknowns of deepwater reservoirs worldwide (figure 3). The risk factors associated with pore pressure and the use of petroleum systems analyses were reviewed briefly in Part 2 of this series (Dec. 2020). Two additional factors to reduce technical and economic risk were the application of recently-developed seismic imaging techniques and the realization that reservoirs could produce at extremely high rates (figures 1 and 4).

Geophysics

Four important geophysical advances preceded the drilling and development of deepwater settings by more than a decade and had a major impact on deepwater exploration and production:

- The digital revolution in seismic recording and processing of the 1960s

- Geophysicists’ recognition of direct hydrocarbon indicator in the early 1970s and use of seismic amplitude information to facilitate the direct detection of hydrocarbons

- The birth of 2-D seismic stratigraphy and using seismic data to infer depositional sequences, via the seminal AAPG Memoir 26 in 1977

- The development and evolution of 3-D seismic technology had the biggest impact on geophysics during the last 50 years, in general, and specifically for deepwater exploration and development.

Even though initial 3-D survey acquisition proved the technology in the 1970s, 3-D surveys did not become practical until the mid-‘80s when computer workstations enabled the interpretation of all these data. Within five to 10 years, 3-D surveys became the most prominent tool for exploration and development globally.

There have also been dramatic improvements in 3-D seismic acquisition with the constant drive to acquire more angles (longer source/receiver offsets), more density receivers (record more samples), more channels (groupings of receivers), more frequencies (broadband), more azimuths (such as wide azimuth-WAZ), etc., with greater efficiency. Within the last five to 10 years, the biggest impact has been broadband seismic, which extends the bandwidth of the data, greatly improving interpretability.

Application of amplitude versus offset technology was developed in the 1980s (figure 1). The concept focuses on changes in amplitude with offset on prestack seismic data, providing insights on fluid effects on the seismic data. Along with the acquisition of 3-D surveys and evolution of AVO technology, seismic processing has continuously improved. During the latter half of the 1990s, prestack time migration algorithms were developed, followed a few years later by prestack depth migration. Prestack depth migration is necessary for accurate imaging below-salt. More recently, full waveform inversion has enabled more accurate delineation of velocity wavefields, and along with broadband processing techniques, has increased the seismic bandwidth to improve resolution.

A key enabler for the advances in geophysical technology has been the increase of computer power. Today’s computer infrastructure allows interpreters to handle vast amounts of 3-D data in a short timeframe and enables the implementation of advanced seismic processing algorithms only dreamed about a few decades ago. This computing power has also enabled the application of machine learning approaches to seismic processing and interpretation. Today, the implementation of ocean bottom node seismic has become more routine in deepwater settings, producing dramatic improvements in seismic imaging and facilitating 4-D seismic interpretation – monitoring seismic response over time.

Geology

The recognition of high-rate, high-ultimate recovery reservoirs led to a major reduction in perceived risk of the economic potential of deep-water production (figures 1 and 2). The HRHU concept, initially developed by Shell geoscientists in the 1980s, refers to certain deepwater reservoirs that can produce initially at high rates and help pay for the initial capital investment. These HR wells also have high ultimate recoveries, meaning that the total reserves justify the large economic investment in the infrastructure. Quantitative thresholds for HRHU designation have varied over time and by company; we define them here as greater than 12,000 boepd and greater than 25 mmboe per well, which represents the top quartile (figure 4).

Initially in the 1990s, the best HRHU reservoirs were recognized in depositional lobes (amalgamated sheet sands) in the northern deepwater Gulf of Mexico, and amalgamated channel-fill in West Africa. These reservoirs have good reservoir drive, good reservoir properties (porosity and permeability), and good oil quality. Importantly, during the 2010s, the pre-salt fields of the Santos Basin (lacustrine microbialites) and the Zohr Field, offshore Egypt (Miocene and Cretaceous carbonate buildup) clearly demonstrate that carbonate strata can also hold HRHU reservoirs.

Note that HRHU reservoirs are defined on the basis of economics. Most deepwater and ultra-deepwater discoveries seek this designation to justify their high exploration and development costs. However, HRHU reservoirs are not always necessary for the economic completion of deepwater reservoirs. Many sedimentary basins of the world are mature basins with well-developed infrastructure (either onshore or offshore). As a consequence, lower rates of production can also be economic. Reservoir quality, connectivity, temperature, depth, fluid pressure, compaction and oil quality are all concerns that must be considered in evaluating the economic potential of HRHU reservoirs.

Economic Considerations

The economics of deepwater development are extremely challenging. Broadly speaking, profitability depends on five factors:

- Product price (figure 1): the average oil or gas price received by the operator over the producing life of the field

- The cost to drill and produce

- The rate at which fields can produce

- The contract terms and regulations required by the host government (especially for deepwater fields), which directly impact costs and revenues

- Cash flow over time, meaning the net sum of cash inflow and outflow over the entire lifespan of a project, corrected for inflation over time

Commodity Prices

The oil (or gas) price received over the life of a field has a first-order effect on deepwater economics. Note that deepwater developments generally have a relatively long field life versus other environments, so that they extend through multiple cycles in the price of petroleum products, thus helping long-term profitability. Costs include capital costs and ongoing expenses associated with exploration and development, plus the ongoing costs to maintain production, including manpower, royalties/rentals, facility/pipeline infrastructure, etc. The timing of the expenses versus revenue can have great impact on profitability. As such, the time from discovery to first production has a large economic impact, with quicker turnaround times desired. Economically successful projects often benefit from good timing versus the cost and oil price cycles, whereas unlucky timing of the same can deteriorate a project’s profitability. The optimal time to begin exploration efforts is when acreage costs are low, usually during price downturns and/or in frontier basins; likewise, the optimal time for drilling and infrastructure is normally during a price downturn, when rig rates are generally lower. In contrast, relatively high oil (or gas) prices during the production phase has great positive impact.

The onset of higher oil prices from 2000 to 2014 coupled with significant exploration success caused increased operator activity. As more operators competed for the same acreage and the same service companies, the cost of purchasing acreage and drilling increased. Established deepwater producers expanded their operations globally and many new companies entered into deepwater exploration. As a result, acreage became more expensive, especially for farm-out deals and “organic” acreage captured by licensing rounds.

Finally, oil-field services became more expensive as demand for them increased. With the downturn in oil prices that started in late 2014, many deepwater developments were delayed and exploration drilling decreased dramatically.

A project’s cash flow over time can be affected by many factors, including time from first investment to first production, speed of regulatory approvals, access to funding and borrowing rates and equity negotiations. For this reason, the dramatic reductions achieved in time from discovery to first production over the last 30 years have had a large impact on economics of many deepwater basins.

Contract terms offered by the host government have a first-order effect on the profitability of deepwater developments, and they vary widely. A commonly-used parameter to characterize the overall economic attractiveness of contract terms is government take, which is the total amount of revenue that a host government receives from production, often expressed as a percentage of total project revenue. Government take can include taxes, royalties and any other government sources of revenue. For production sharing contracts, cost oil recovery and profit oil split constitute a significant portion of the government take. Cost oil recovery is the amount of investment costs which the operator can recover by selling 100 percent of the oil as per contract terms before break-even, whereas profit oil split is the relative amounts of oil that are allotted to the operator versus the host government after break-even.

There is a large variability in economic attractiveness based on typical modeled fields from most of the established deepwater basins (figure 5).

The two economic parameters shown are net present value per barrel of oil equivalent, which determines the economic profit per unit of production, and breakeven price, which represents the average product price over the life of a project that corresponds with zero profitability (as in, no profit, no loss). NPV/BOE ranges from less than $1 to more than $10/BOE.

Breakeven price is a key parameter when considering economic risk.

For the modeled fields in figure 5, those from Indonesia, Egypt and Malaysia have high breakeven costs, making profitable development of discoveries problematic; conversely, the UK, Canada and Norway have breakeven prices less than $30/boe. It is important to note, however, that terms are often re-defined or can be re-negotiated post-discovery to make a project profitable – for instance, in deepwater Egypt, where the gas price received is negotiated after discovery.

With a few exceptions, higher breakeven prices generally correlate with higher percentages of government take; all points with NPV per barrel of oil equivalent below $5 are associated with government takes of 70 percent or higher. Not surprisingly, countries without established deepwater production as a group have relatively lower breakeven prices, due to more attractive contract terms being used as an incentive for exploration companies.

Service costs such as deepwater rig day rates and evaluation operations have decreased dramatically since 2015, contributing to a large improvement in breakeven prices, from as high as $70 per boe to as low as $25 per boe. Today, breakeven prices vary in different deepwater basins, according IHS Markit’s Bob Fryklund in a 2021 personal communication:

- Northern GOM, $20/boe for subsea tiebacks and $25-30/boe for stand-alone developments

- Santos Basin, Brazil, pre-salt fields are $30- 35 /bbl, depending on the amount of CO₂ and total field size

- Guyana, $30- 35/ bbl depending on the field size and reservoir

In summary, the economics of deepwater exploration runs on a 15- to 30-year time frame. With such a long development cycle, the producing life of a typical deepwater discovery normally coincides with several different oil and gas price cycles (figure 1). While adding short-term risk associated with price downturns, deepwater production can also offer some economic stability over the long term. This is in sharp contrast to onshore, unconventional shale plays, for which the life-cycle of individual producing wells is generally a few years at most.

Acknowledgments: We thank the following colleagues for their input and review of the materials presented here: Flavio Feija, Bob Fryklund, Miki Gardosh, Laurie Lamar, Niven Shumaker, Matthew Silverman, Mike Sweet, Gabor Tari, Tomas Villamil and Chandler Wilhelm. Their help was essential to finalizing the paper.